(This article was published in The Economic Times (Networked section), 23rd November 2000 issue)

“Societies have always been shaped more by the nature of the media by which men communicate than by the content of the communication…. Innumerable confusions and a profound feeling of despair invariably emerge in periods of great technological and cultural transitions. Our “Age of Anxiety” is, in great part, the result of trying to do today’s job with yesterday’s tools – with yesterday’s concept’s.”

– Marshall McLuhan, The Medium is the Message, 1967

With the Indian government’s recent decision to allow private companies to own and operate their own gateways to the Internet, it wont be long before we start seeing broadband Internet access making inroads into the Indian market. Whether this is in the form of DSL, cable access, Wireless (3G etc.), Direct to Home Satellite based (DirecPC etc.), or any other technology its impact on the traditional broadcasting industry (amongst others) is inescapable. Content will be the main driver for mass-market broadband penetration, with users migrating to broadband seeking a better Web experience despite the stiff initial price. Although later price cuts will help push up the number of subscribers to double (or more), compelling new content will be the key to attracting the average person to broadband.

In the early days of the World Wide Web, PointCast and the similar start-ups that pioneered the idea of sending content to computer screens around the planet, applied “push” technology-they pushed content onto the user’s screen rather than waiting for the user to pull it from the server. But this technology failed to deliver what those users really wanted: digital-quality video and audio, on demand, over the Internet. Even though the push business model is dead, the goal of delivering high-quality video over the Internet lives on in the form of “media streaming.”

Companies that deploy the streaming technology are using it to leapfrog traditional media companies, which have been reluctant to bring interactivity to TV. In so doing, the attackers are stealing the broadcasters’ most valuable treasure: the audience. This obviously has traditional media players worried; a sure indicator of this being lawsuits filed against video-streaming companies and hectic lobbying for governments to put in place new restrictive legislation.

The defensive stance of the broadcast industry and the holders of content rights is easy to understand, since the media-streaming market is projected to grow from under $1 billion in 2000 to nearly $10 billion by 2005.

Streaming video is beginning to get real consumer attention. More than twice as many people downloaded the Real Networks streaming player in the first nine months of 1999 than in all of 1997 and 1998. By the end of 1999, upward of 98 million users had downloaded it. Each of the top ten Webcasts of 1999 attracted more than 500,000 viewers; with the year’s top event, Paul McCartney’s concert at the Cavern Club (Liverpool), being streamed to more than 5 million viewers.

Streaming video may not yet be a real substitute for television broadcasts, as anyone who has endured the small, grainy video windows of computer screens will tell you. But improvements in technology are rapidly narrowing the difference in quality between streaming and broadcast video. Media-streaming players can now stream at a near full-motion rate of 30 frames a second, up from 8 frames a second only two years ago. At the same time, broadband distribution is making it possible to deliver video streams at bit rates that are close to broadcast quality. Another enabling factor is the development of new technologies like IP multicast and Vtrails (of Israel) technology called Full Duplex Packet Cascading (FDPC); which reduce bandwidth and server capacity requirements for internet broadcasts to multiple clients.

As the quality of streaming media reaches broadcast-television levels, the competition for eyeballs is set to become really intense, causing the broadcasters’ share of audiences (and thus of advertising revenues) to fall rapidly. Broadcast networks as well as cable and satellite providers, will have to adapt to this new force in video distribution or face a huge loss of viewer ship.

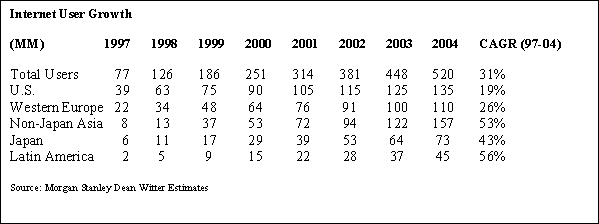

Source: Morgan Stanley Dean Witter

If traditional broadcasters properly leverage their brands in the digital world, streaming can potentially be of substantial value to them. Broadcasters should begin streaming their content so they can offer viewers a varied and interactive experience-the ability to watch events live or on demand, to choose from a wider range of programming, to be able to select different camera angle from which to watch a live sports event, to watch news and gossip, and to participate in events and shows through chats, polls, and quizzes. This new medium provides for the capture of new revenue streams, including data-mining revenue and electronic-commerce revenue from the sale of merchandise and tickets. Beyond generating immediate revenue, the streaming of content will prepare traditional broadcasters for a multi-platform world. Whether the television, the PC, or a broadband Internet appliance becomes the dominant device for residential access, broadcasters must get ready for the future by developing streaming content and the related infrastructure and business models.

Broadcasters must develop robust streaming sites with rich interactive content. To attract viewers to their Web sites they ought to pre-pare complementary content for their current TV programming, as the World Wrestling Federation has already done (and very successfully). They could begin streaming previews and other kinds of short-form content, including interviews with celebrities and TV personalities, using existing streaming service providers. For example, Star TV Networks, www.youpicktheflick.com initiative. Beyond that, broadcasters might begin streaming whole shows (as ABC has done), or streaming alternative “not for TV” versions of shows. If consumer demand is strong enough, broadcasters might then migrate all their programming to their Web sites. The networks would be unwise to create their own streaming providers, for they lack the required skills, notably the ability to develop distributed networks and streaming applications. However, broadcasters might partner with, and perhaps take equity stakes in, developers of streaming applications. In this way, the broadcasters can make sure that tailored applications for delivering their streamed content are created. Through this arrangement, broadcasters could capture a share of the value created by the streaming of their content.

As content providers, cable networks face the same threats that traditional broadcasters do: the erosion of their audience and advertising revenue base. Like broadcasters, they should embrace streaming to improve their content and extend their brands. But cable network operators (CNOs) -companies that provide the infrastructure to deliver cable television to customers’ homes-are in a different position. Because CNOs are among the best-positioned providers of last-mile bandwidth to the home, they represent a critical link in the streaming-media value chain and are thus poised to extract value from access, content, commerce, and communications.

CNOs could also leverage their last-mile infrastructure to extract value from the streaming service providers. It would be no surprise to see streaming providers enter into a strategic and financial partner-ship with a Cable Network Operator to ensure that their content was delivered to consumers. A short-form video opportunity that might make sense would be to develop an Internet video ad-serving capability over the last-mile networks. Cable ISPs could use the individual behavior of consumers to send them targeted pop-up video ads. After gaining the ability to stream video to cable modem subscribers, CNOs could also take advantage of the many opportunities to enhance existing e-commerce-based products and services with video. Siticable for instance, could partner with Bazeee.com to stream video auctions. FTV could partner with fashion houses Secret to stream runway shows that would permit consumers to buy as they watched.

Broadcasters and cable companies are facing a technological discontinuity that will change the way entertainment and information reach customers. If these companies want to stay in the game, they will have to embrace the emerging technology and use it to drive innovation and value.

“In the Age of Revolution it’s the incumbents against the insurgents, the old guard versus the vanguard, the hierarchy of experience clashing with the hierarchy of imagination.

You know which way to bet.”

*References: The McKinsey report written by – Ashish Bhandari, Hamid Biglari, Michael Burstein, Andre Dua, and John Rose. Graphs and statistics used are from the Morgan Stanley Dean Witter “Global Internet Primer” report. Other references used: “IP Multicast Backgrounder” available at www.ipmulticast.com, “Sharing the Streaming Burden” by Tania Hershman (Wired News- www.wired.com).